Goal:

Predict the trend of Funds Inflow using historical time series data.

import matplotlib.pyplot as plt

import pandas as pd

import numpy as np

import statsmodels.api as sm

from statsmodels.tsa.arima_model import ARIMA

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import adfuller as ADF

user_balance = pd.read_csv('./user_balance_table.csv')

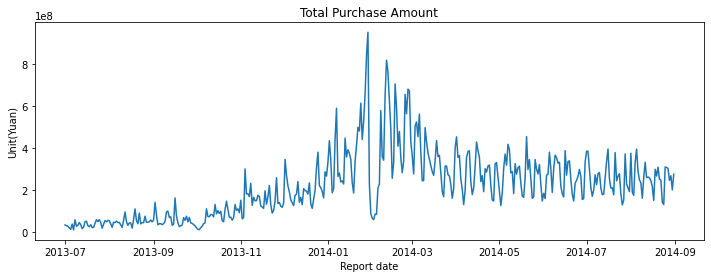

1. EDA

#chunk1: EDA

user_balance = pd.read_csv('./user_balance_table.csv')

df_tmp = user_balance.groupby(['report_date'])['total_purchase_amt','total_redeem_amt'].sum()

df_tmp.reset_index(inplace = True)

df_tmp['report_date'] = pd.to_datetime(df_tmp['report_date'],format = '%Y%m%d')

df_tmp.index = df_tmp['report_date']

plt.figure(figsize = (12,4))

plt.plot(df_tmp['total_purchase_amt'])

plt.title('Total Purchase Amount')

plt.xlabel('Report date')

plt.ylabel('Unit(Yuan)')

plt.show()

2. training, testing data preparation

#chunk2: split train and test dataset

def split_dataset():

desparse = lambda date:pd.to_datetime(date,format = '%Y%m%d')

user_balance = pd.read_csv('./user_balance_table.csv',parse_dates = ['report_date'],index_col = 'report_date',date_parser = desparse)

df = user_balance.groupby(['report_date'])['total_purchase_amt'].sum()

timeseries = pd.Series(df,name = 'value')

train_seq = timeseries['2014-04-01':'2014-07-31']

test_seq = timeseries['2014-08-01':'2014-08-10']

train_seq.to_csv('./purchase_seq_train.csv',header = True)

test_seq.to_csv('./purchase_seq_train.csv',header = True)

return train_seq,test_seq

train_seq,test_seq = split_dataset()

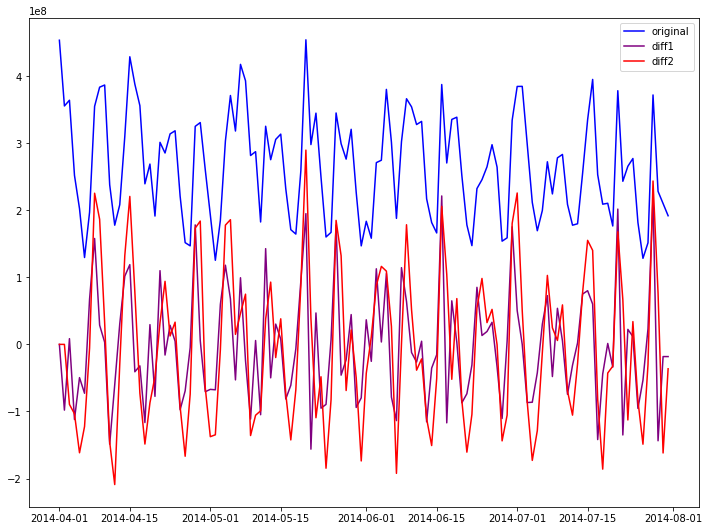

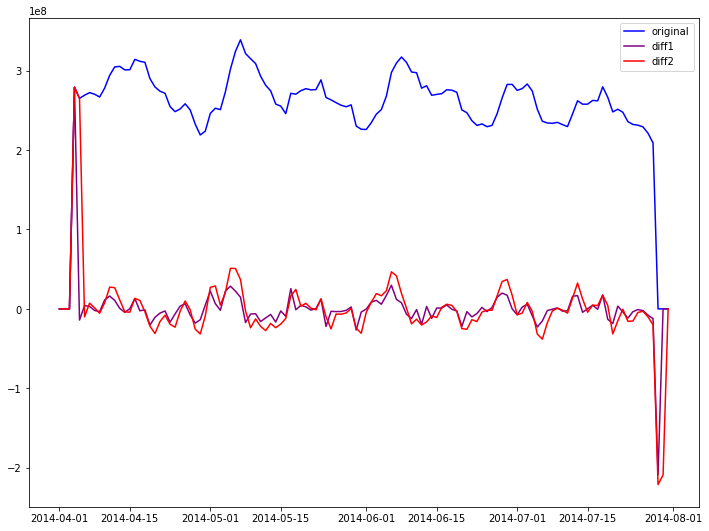

3. ADF Test

Aim: check whether trainning timeseries is stationary

#chunk2:

#if not stationary: try lag1 series,lag2 series

#if stationary: observe the PACF,ACF plot and select best p,q parameters for ARIMA model

def adf_check(timeseries):

seq_diff1 = timeseries.diff(1)

seq_diff2 = timeseries.diff(2)

seq_diff1 = seq_diff1.fillna(0)

seq_diff2 = seq_diff2.fillna(0)

adf0 = ADF(timeseries)

adf1 = ADF(seq_diff1)

adf2 = ADF(seq_diff2)

print('timeseries ADF test critical value is ',adf0[0],',p-value is ',adf0[1])

print('timeseries diff1 ADF test critical value is ',adf1[0],',p-value is ',adf1[1])

print('timeseries diff2 ADF test critical value is ',adf2[0],',p-value is ',adf2[1])

plt.figure(figsize = (12,9))

plt.plot(timeseries,color = 'blue',label = 'original')

plt.plot(seq_diff1,color = 'purple',label = 'diff1')

plt.plot(seq_diff2,color = 'red',label = 'diff2')

plt.legend(loc = 'best')

plt.show()

adf_check(train_seq)

timeseries ADF test critical value is -2.0639747511769917 ,p-value is 0.2592449964335145

timeseries diff1 ADF test critical value is -6.542516143607555 ,p-value is 9.270661450977037e-09

timeseries diff2 ADF test critical value is -6.720937259404168 ,p-value is 3.4845842233567905e-09

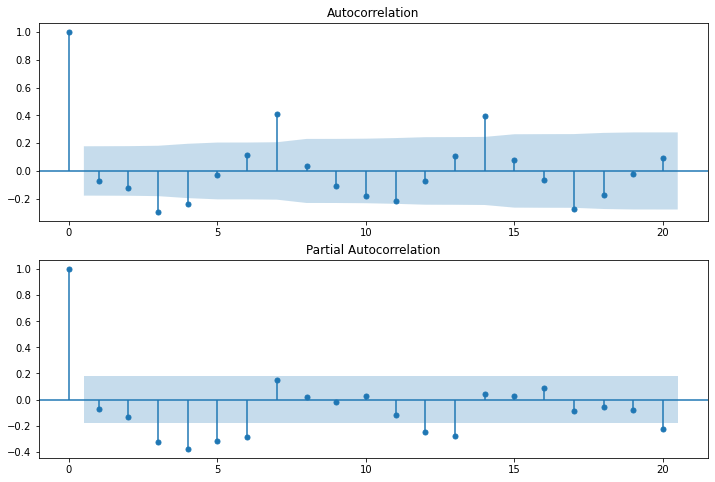

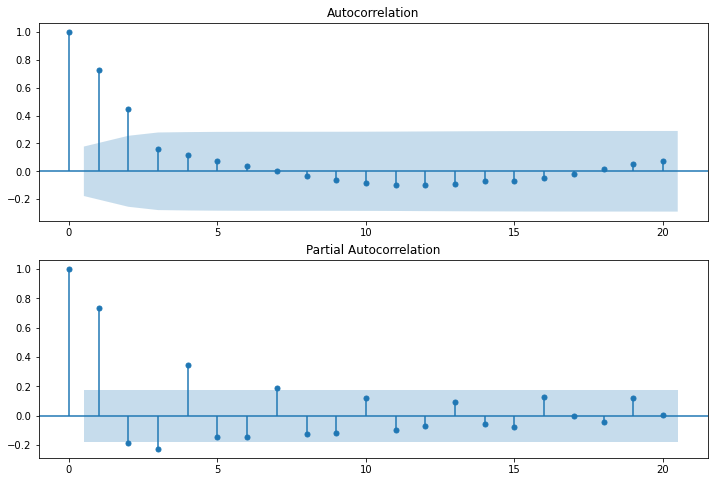

3. Hyperparatemer tuning

#chunk3: Select p,q parameters by observing PACF,ACF plot

def autocorrelation(timeseries,lags):

fig = plt.figure(figsize = (12,8))

ax1 = fig.add_subplot(211)

sm.graphics.tsa.plot_acf(timeseries,lags = lags,ax = ax1)

ax2 = fig.add_subplot(212)

sm.graphics.tsa.plot_pacf(timeseries,lags = lags,ax = ax2)

seq_diff1 = train_seq.diff(1)

seq_diff1 = seq_diff1.fillna(0)

autocorrelation(seq_diff1,20)

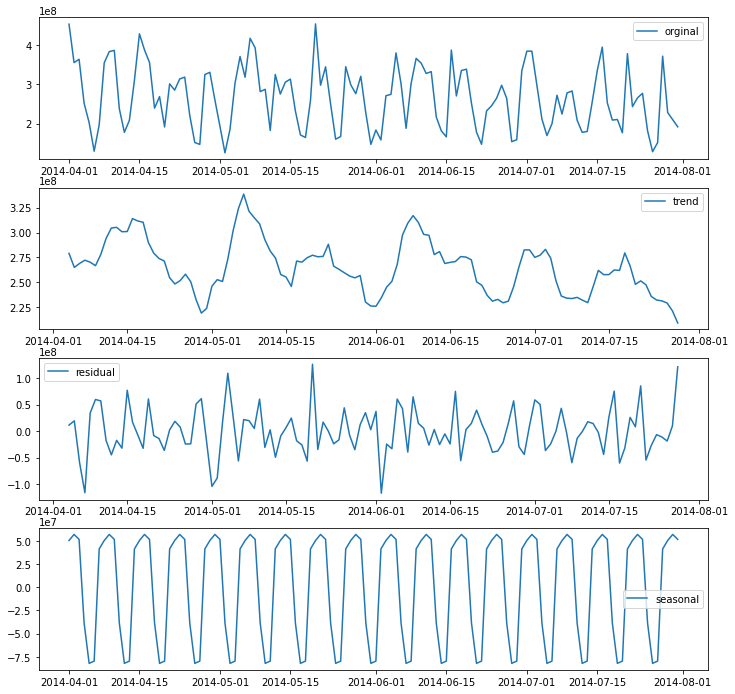

4. Seasonal and Trend decomposition using Loess(STL)

#chunk4: Seasonal and Trend decomposition using Loess(STL)

def decompose(timeseries):

decomposition = seasonal_decompose(timeseries)

trend = decomposition.trend

residual = decomposition.resid

seasonal = decomposition.seasonal

plt.figure(figsize = (12,12))

plt.subplot(411)

plt.plot(timeseries,label = 'orginal')

plt.legend(loc = 'best')

plt.subplot(412)

plt.plot(trend,label = 'trend')

plt.legend(loc = 'best')

plt.subplot(413)

plt.plot(residual,label = 'residual')

plt.legend(loc = 'best')

plt.subplot(414)

plt.plot(seasonal,label = 'seasonal')

plt.legend(loc = 'best')

decompose(train_seq)

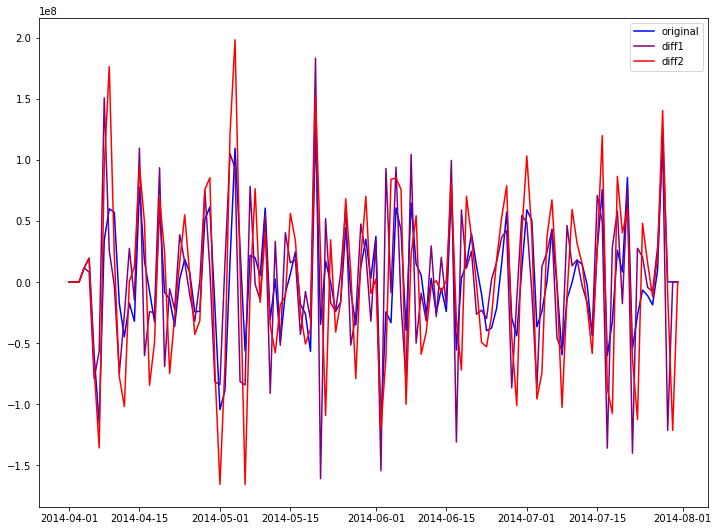

5. Recheck stationary after decomposition

decomposition = seasonal_decompose(train_seq)

trend = decomposition.trend

residual = decomposition.resid

seasonal = decomposition.seasonal

trend = trend.fillna(0)

residual=residual.fillna(0)

adf_check(trend)

adf_check(residual)

timeseries ADF test critical value is -3.2368487584485863 ,p-value is 0.017948383665881567

timeseries diff1 ADF test critical value is -10.571816201699768 ,p-value is 7.2723798146224e-19

timeseries diff2 ADF test critical value is -4.27332487528888 ,p-value is 0.0004939083331880952

timeseries ADF test critical value is -6.290212104648341 ,p-value is 3.614727756796546e-08

timeseries diff1 ADF test critical value is -5.903150268380998 ,p-value is 2.7477376300415804e-07

timeseries diff2 ADF test critical value is -5.802841045335451 ,p-value is 4.588223613597985e-07

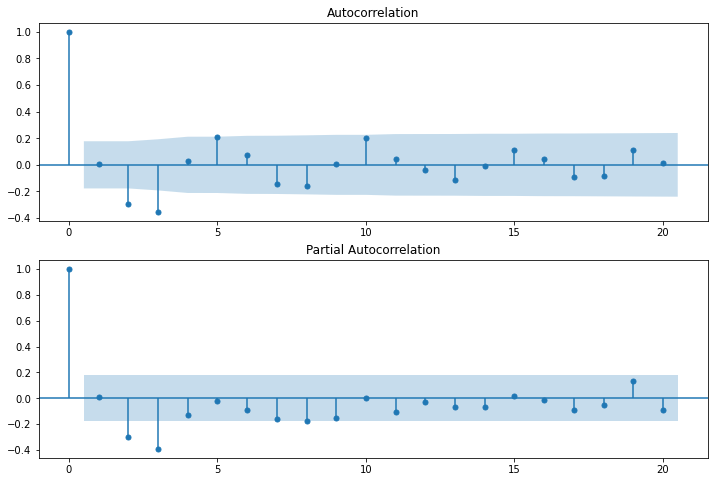

autocorrelation(trend, 20)

autocorrelation(residual, 20)

6. Model delection

#chunk5: AIC, BIC for model selection

trend_evaluate = sm.tsa.arma_order_select_ic(trend,ic = ['aic','bic'],trend = 'nc',max_ar = 4, max_ma = 4)

print('trend AIC',trend_evaluate.aic_min_order)

print('trend BIC',trend_evaluate.bic_min_order)

resid_evaluate = sm.tsa.arma_order_select_ic(residual,ic = ['aic','bic'],trend = 'nc',max_ar = 4, max_ma = 4)

print('residual AIC',resid_evaluate.aic_min_order)

print('residual AIC',resid_evaluate.bic_min_order)

trend AIC (1, 0)

trend BIC (1, 0)

residual AIC (2, 1)

residual AIC (2, 1)

#chunk3: ARIMA model building

trend_model = ARIMA(trend,(1,0,0))

trend_model = trend_model.fit(disp = False)

trend_fit_seq = trend_model.fittedvalues

trend_pred_seq = trend_model.predict(start = '2014-08-01',end = '2014-08-10',dynamic = True)

resid_model = ARIMA(residual,(2,0,1))

resid_model =resid_model.fit(disp = False)

resid_fit_seq = resid_model.fittedvalues

resid_pred_seq = resid_model.predict(start = '2014-08-01',end = '2014-08-10',dynamic = True)

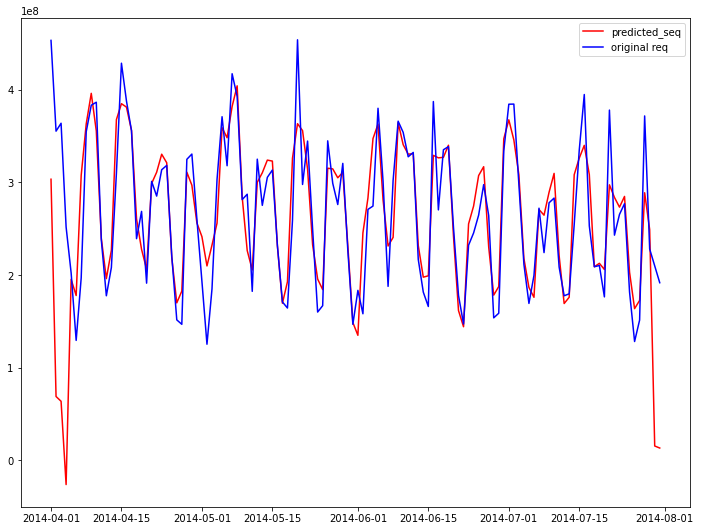

7 . Model Fitting

#chunk4: Fitting Moldel

fit_seq = seasonal

fit_seq = fit_seq.add(resid_fit_seq,fill_value = 0)

fit_seq = fit_seq.add(trend_fit_seq,fill_value = 0)

plt.figure(figsize = (12,9))

plt.subplot(111)

plt.plot(fit_seq,label = 'predicted_seq',color = 'red')

plt.plot(train_seq,label = 'original req',color = 'blue')

plt.legend(loc = 'best')

plt.show()

#making prediction

seasonal_pred = seasonal['2014-04-04':'2014-04-13']

predict_dates = pd.Series(

['2014-08-01', '2014-08-02', '2014-08-03', '2014-08-04', '2014-08-05', '2014-08-06', '2014-08-07', '2014-08-08',

'2014-08-09', '2014-08-10']).apply(lambda dates: pd.datetime.strptime(dates, '%Y-%m-%d'))

seasonal_pred.index = predict_dates

pred_seq = seasonal_pred

pred_seq = pred_seq.add(resid_pred_seq,fill_value = 0)

pred_seq = pred_seq.add(trend_pred_seq,fill_value = 0)

<ipython-input-44-02d92dd51741>:17: FutureWarning: The pandas.datetime class is deprecated and will be removed from pandas in a future version. Import from datetime module instead.

'2014-08-09', '2014-08-10']).apply(lambda dates: pd.datetime.strptime(dates, '%Y-%m-%d'))

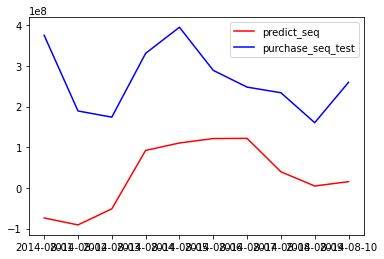

#8. Measure Performance

#chunk5: Measure Performance

plt.plot(pred_seq, color='red', label='predict_seq')

plt.plot(test_seq, color='blue', label='purchase_seq_test')

plt.legend(loc='best')

plt.show()

def mean_absolute_percentage_error(y_true, y_pred):

y_true, y_pred = np.array(y_true), np.array(y_pred)

return np.mean(np.abs((y_true - y_pred) / y_true)) * 100

mean_absolute_percentage_error(test_seq,pred_seq)

92.45641079826935

from sklearn.metrics import mean_absolute_error

def mean_absolute_scaled_error(y_true, y_pred, y_train):

e_t = y_true - y_pred

scale = mean_absolute_error(y_train[1:], y_train[:-1])

return np.mean(np.abs(e_t / scale))

mean_absolute_scaled_error(test_seq,pred_seq,train_seq)

3.5125341730575683